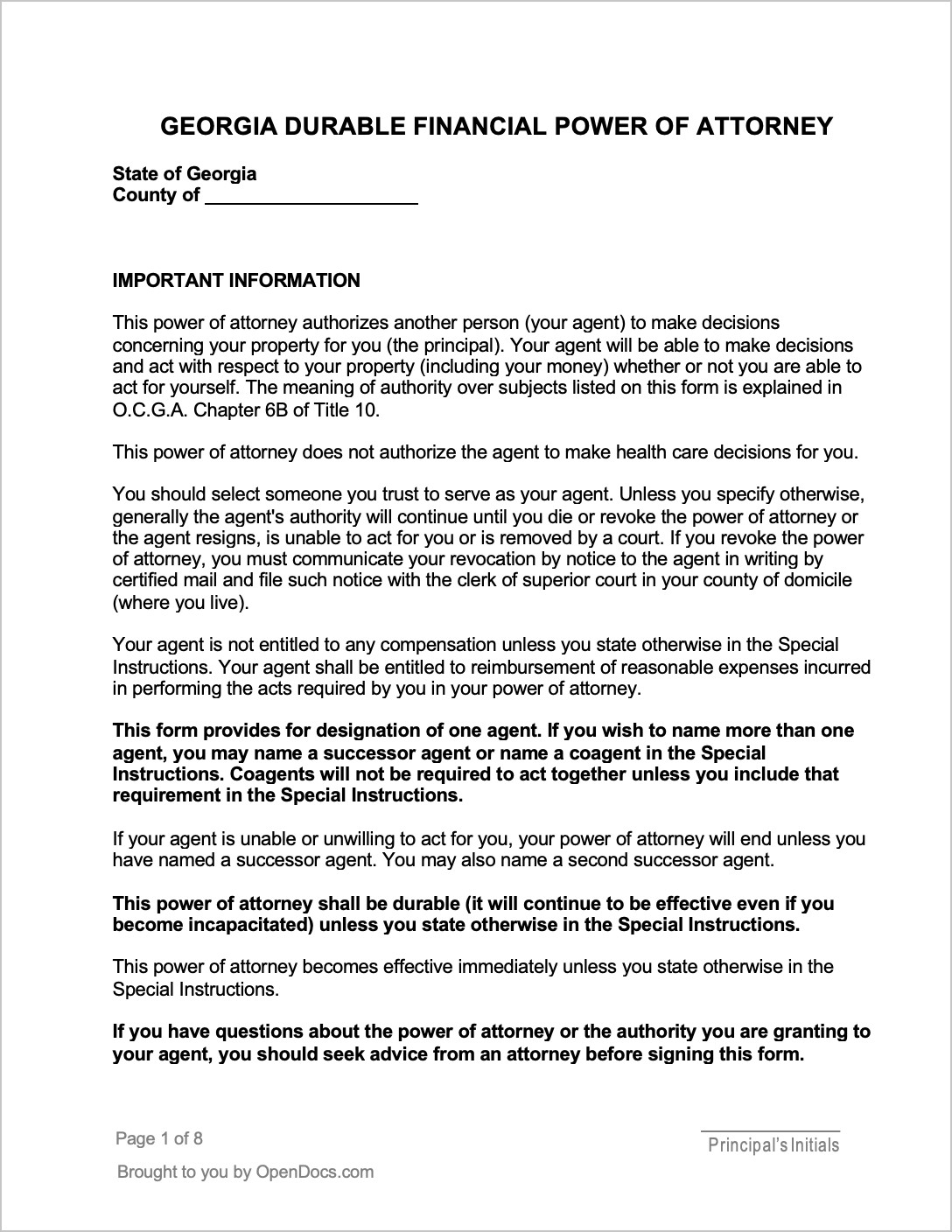

In that case, you may execute a limited DPOA by nominating the person you want serving as your conservator or guardian. You may feel that it would be better to have the probate court monitor the person handling your affairs through a guardianship or conservatorship. (Note that you are not required to choose a family member as your agent you may opt to appoint a professional, such as attorney or accountant.) You would be well advised to select someone who you believe will act in your best interest and whom you consider responsible and organized. Choosing an agent is a significant decision. While you should seriously consider executing a durable POA, you may not have someone you trust to appoint. Many attorneys counsel their clients to create living trusts in part to avoid this sort of problem with powers of attorney. To avoid problems, you may want to execute such forms offered by the institutions with which you have accounts. Many banks or other financial institutions have their own standard power of attorney forms. Still, some institutions go overboard, for example requiring that the attorney-in-fact indemnify them against any loss. However, the financial institution wants to verify that this person indeed has the authority to act on your behalf. Someone may step forward and claim to represent you, the account holder. Getting banks or other financial institutions to recognize the authority of an agent under a DPOA can sometimes be challenging.Ī certain amount of caution on the part of financial institutions is logical. Do Banks Accept Durable Power of Attorney? In such cases, it is essential to clearly define in the document the standard not only for determining incapacity, but also triggering the POA. However, the document can also be written so that it does not become effective until such incapacity occurs. However, the understanding is that the POA will not be used until and unless the grantor becomes incapacitated. A general POA is comprehensive and gives your attorney-in-fact all the powers and rights that you have yourself.Ī power of attorney may also be either current or " springing." Most powers of attorney take effect immediately upon their execution. Similarly, it may allow someone to sign checks for you. A limited POA can give someone the right to sign a deed on your behalf when you are out of town. Under a simple durable power of attorney, they could have implemented such steps immediately.) Other Types of Power of AttorneyĪ power of attorney may also be limited or general. (Under a guardianship, your agent also may have to seek court permission to take planning steps. That court process takes time, costs money, and the judge may not choose the person you would prefer. Without a durable power of attorney (DPOA), no one can represent you unless a court appoints a conservator or guardian.

What If I Don't Have a Durable Power of Attorney?

If your POA is durable, it means it will remain in effect even if you become incapacitated. Were you to endure a debilitating injury, illness, or disability and become unable to manage your own affairs, having a durable power of attorney can be ideal.

Or perhaps you are a business owner who would like a POA in place so that an agent can stand in your place to buy and sell assets. When you have a power of attorney (POA) in place, you have appointed someone as your “attorney-in-fact” or “agent.” This appointee is someone you trust who is allowed to step in and act in your place when necessary.įor example, you may grant power of attorney to an agent to handle financial transactions on your behalf for when you are traveling. For most people, the durable power of attorney is the most important estate planning document available.

0 kommentar(er)

0 kommentar(er)